This Week in Australian Startups - 1st February, 2023

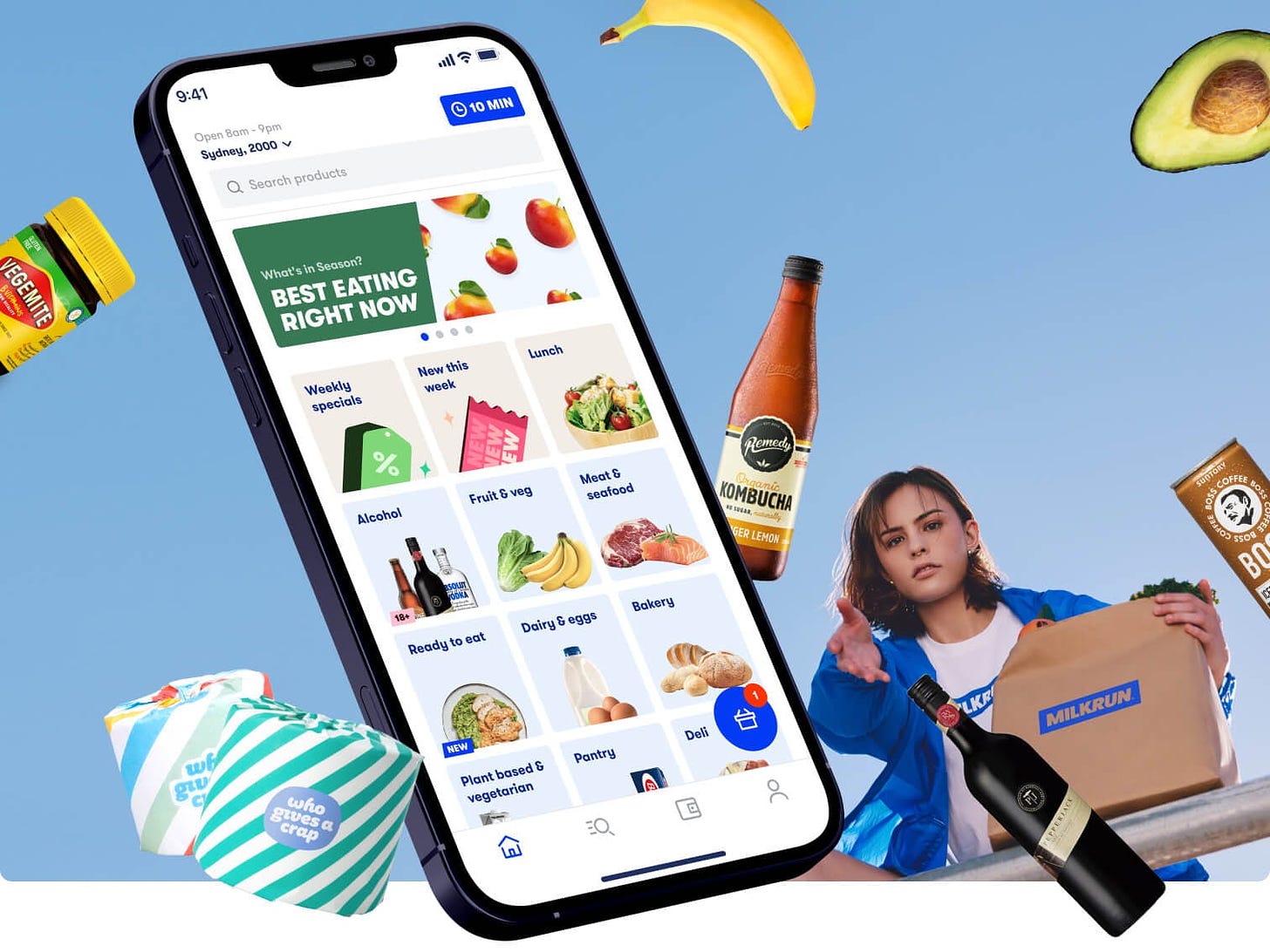

In an exclusive report, The Australian, claims Milkrun has failed in multiple attempts to raise a Series B a little over 12 months after a huge $75M Series A led by Tiger Global, Grok Ventures, AirTree Ventures, and Skip Capital.

If you haven’t been following Milkrun or the grocery delivery industry, perhaps this may come as a surprise - but it’s something that was absolutely to be expected. This doesn’t mean Milkrun won’t raise a successful Series B and continue operating, but the economics have changed dramatically.

In Europe in the last 12-24 months we’ve seen huge consolidation in this space. Getir acquired Weezy, Gopuff acquired Dija and Fancy, Getir acquired Gorillas for $1.2B. The last one was the most significant, it all but unified grocery delivery across all of Europe making the combined company of Getir and Gorillas worth almost $10B. At home, whilst not through acquisition Milkrun is the last grocery delivery app left with the closure of Send, Voly, and Quicko - a consolidation nonetheless.

There’s a few things at play here for me.

1. VCs don’t like loss making startups anymore

With so much competition in the space, grocery delivery apps had no real loyalty. It was a low cost race with consumers waiting for the next coupon or whichever app would get them their eggs cheapest and quickest. Similar to price wars with ride sharing apps we’ve seen in the past, when new players enter the market in the race for market share.

This model relies on paid acquisition to not only grow but keep existing customers was costly, and mostly funded by money raised by VCs in the form of on going coupons and discounts.

A consolidation in the space was natural. So many of these startups had no differentiation except for their branding and geographies they served - it would be naive to think many of these founders didn’t start these with the strategic vision to be acquired by a larger player who understands it’s cheaper to buy than spending money to grow into these new geographies. And there’s nothing wrong with that, it’s a common strategy - what’s a business successful overseas that doesn’t exist in your local market, you’ve got the playbook, go build it and then try and sell it when that business looks to enter your market.

2. Grocery shopping is an experience, and subjective

Grocery shopping is not your typical eCommerce experience. Especially when it comes to fresh fruit and vegetables consumers want to pick the product that is the level of ripeness for them and not be left with someone else choosing for them.

Yes time is money, and there is value in paying a premium for the same product through a grocery delivery service - especially if a full grocery run may take anywhere from 30 mins-1 hour. There are some people that just want to do it themselves, worried the right apple may not be picked or want to pick their owns substitute if their favourite brand of cereal is out of stock.

Let’s also not forget how expensive the cost of living has become, where even saving 10% on your groceries buying it direct is worthwhile.

3. Supermarkets aren’t sitting by idly

Click and collect, direct to boot - Coles and Woolworths are evolving and catching up with the times. They already have the distribution networks and locations across the entire country to serve a larger population and retain its customer base with their evolving needs. It’s easier for most consumers to choose one of these options if they aren’t in the service area for Milkrun, who has a very limited service area in limited areas in inner city Sydney and Melbourne outside of the CBD - despite living within 6km of the Sydney CBD even I fall outside of the limited service area.

The biggest game changer I’ve witnessed is subscription services. I never would have thought I would be paying for a subscription to Woolworths for groceries, but the offer is very compelling.

Even if I lived in a Milkrun service area - I would rather pay the $7/month or $59/year for Everyday Extra as it provides much greater value. 10% each month on one shop (including Big W) means I could be getting a free shop per year if I can do a big monthly shop. With the cost of groceries skyrocketing this means I save anywhere from $200-400 per year (or one free shop per year) not to mention the additional rewards points I can earn and redeem.

There is still a market for grocery delivery, within a few hours or even next day, but the model may need to change - Woolworths recently launched Metro60, groceries delivered in under 60 minutes in a limited service area. Instacart is different where they do not have local warehouses/shops with stock, they will go into the supermarket of your choice and do the physical shop and deliver it to your door.

I think we’ll see a similar trend across markets like Europe and the US with traditional supermarkets adopting a similar approach and winning back the market.

Top News

Hacker finds bug that allowed anyone to bypass Facebook 2FA, more here

Queensland edtech unicorn Go1 gobbles up UK rival Anders Pink, more here

The Finnies: FinTech Australia launches new ‘positive impact’ award, more here

LaunchVic’s hunt for the next wave of tech unicorns is on again, more here

Spotify is first music streaming service to surpass 200M paid subscribers, more here

Salesforce sheds its Australian VC arm amid swingeing job cuts, more here

Would Baidu’s answer to ChatGPT make a difference? More here

Luggage startup July nabs Little Birdie’s Joanne Smith as its first CFO, more here

Microsoft, Nintendo, and Sony are reportedly all skipping E3 2023. More here

Startmate boss Michael Batko asked 15 leading startup founders ‘how do you CEO?’ – here’s what he learnt, more here

Fallen Unicorns: Startup Billionaires Nearly $100 Billion Poorer Than A Year Ago, more here

Melbourne Uni’s new VC fund, Tin Alley Ventures, sets $200 million target after reaching $100m. More here

Groupon cuts another 500 employees in the second round of layoffs, more here

2023 Layoffs: PayPal, HubSpot And HarperCollins Announce Cuts, more here

Meta is testing members-only worlds for its social VR platform, more here

Impossible Foods planning to lay off 20% of staff, more here

TikTok CEO to testify before Congress in March, more here

Amid growing competition, Paramount+ and Showtime are combining in the US. More here

Stripe eyes an exit over next 12 months, more here

Bob Iger’s big changes at Disney could lead to more layoffs, more here

The current legal cases against generative AI are just the beginning, more here

Australian Funding Rounds

Catering marketplace FoodByUs raises $12 million in Series B, more here

Self-employed bookkeeping platform Hnry books $35 million Series B, more here

Employee wellbeing startup Foremind raises $200,000 for construction industry mental health support, more here

Quantum startup Q-CTRL lands $39 million in Series B top up led by Salesforce Ventures, more here

International Highlights

Raylo raises $136M to build out its gadget lease-and-reuse ‘fintech’ platform, more here

Marqeta buys fintech Power Finance in $275M all-cash deal, its first acquisition. More here

Pfizer Ventures co-leads £40m funding in Grey Wolf Therapeutics, more here

This startup hopes to take on Canva, raising an $11.6M Series A for its design platform. More here

France’s Welcome to the Jungle raises €50m Series C, more here

Crowdbotics raises $40M to help devs build apps from modular code, more here