This Week in Australian Startups #74, 30th June 2024

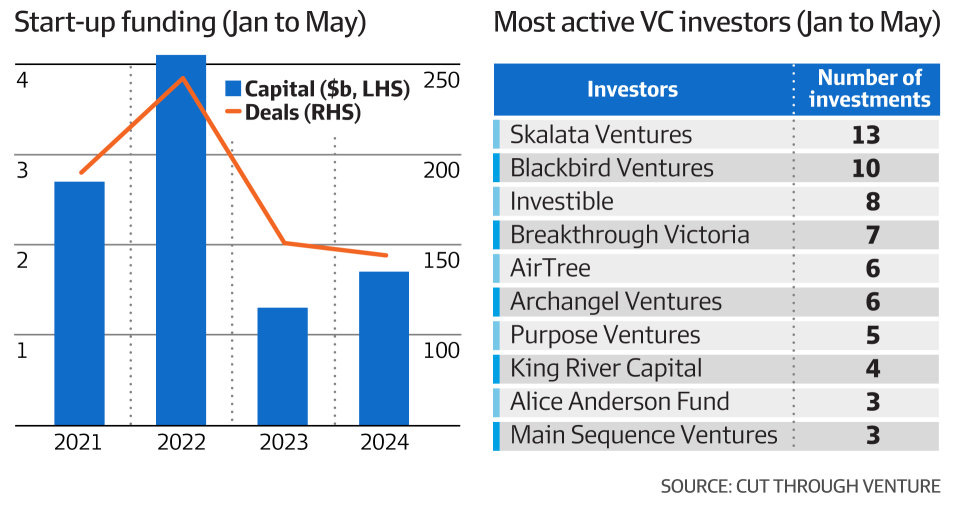

Cut Through Venture has released an early H1 review of VC funding, in an exclusive for the AFR.

Here’s the stats you need to know:

Funding up 30% YoY for the same period (Jan to May)

Deals down from 151 to 144

Mega deals ($100M+ rounds) are coming back

AI/Big Data startups made up 5% of total VC investment across 11 rounds totalling $75M

Gender split of funding

85% to all male teams

5% to all female teams

10% to mixed teams (at least one female founder)

And here’s my raw take/thoughts:

There’s still a lot of ‘dry powder’ in the market - LPs don’t give VCs money to just keep in the bank account under management, it’s given to deploy and invest to get a return. Whilst it’s getting tougher for VCs to raise in general, there’s still plenty of capital being raised across the board from big and small VCs in Australia. This capital will need to be deployed - most of it will be in Australia.

We should see this trend continue - difficult to say if 2024 will be the year ‘things go back to normal’, but I'd be comfortable to take a punt and say it’s going to be bigger than 2023 as most people would be too.

The number of deals are down, but total capital is up - this is reflective of better due diligence on both sides. Startups are bootstrapping for longer, out of desire in many cases and out of necessity in others.

A recent survey by SaaStr showed that 64% of founders would prefer to raise less or bootstrap if they had to do it all over again. Things post ZIRP mean it’s not sexy on both sides to ‘grow at all costs’ - more founders are happy to take it slow and steady and raise at the right moment.

Often that right moment is when rounds can get bigger - a startups valuation is stronger, likely due to already achieving PMF or profitability putting them in a stronger position at the table = bigger rounds. And of course there are industries like AI and deep tech that require more investment upfront.

For VCs it’s that plus but also the fundamentals of the entire model is the same - one unicorn pays the fund off. Many of these new funds (globally) are being raised with AI in mind - it’s still too early to tell whether it’s a winner takes all (first across the line) or if the pie is big enough for more. The LLM race indicates it might be a winner takes all with OpenAI in prime position, and that’s setting the tone downstream for the rest of the AI industry. This means VCs will be deploying more capital to take more bets which may mean more losses down the line = more funding.

Diversity continues to be a topic that is being talked about, which is so important and great to see. The numbers continue be dismal, and that’s putting it nicely.

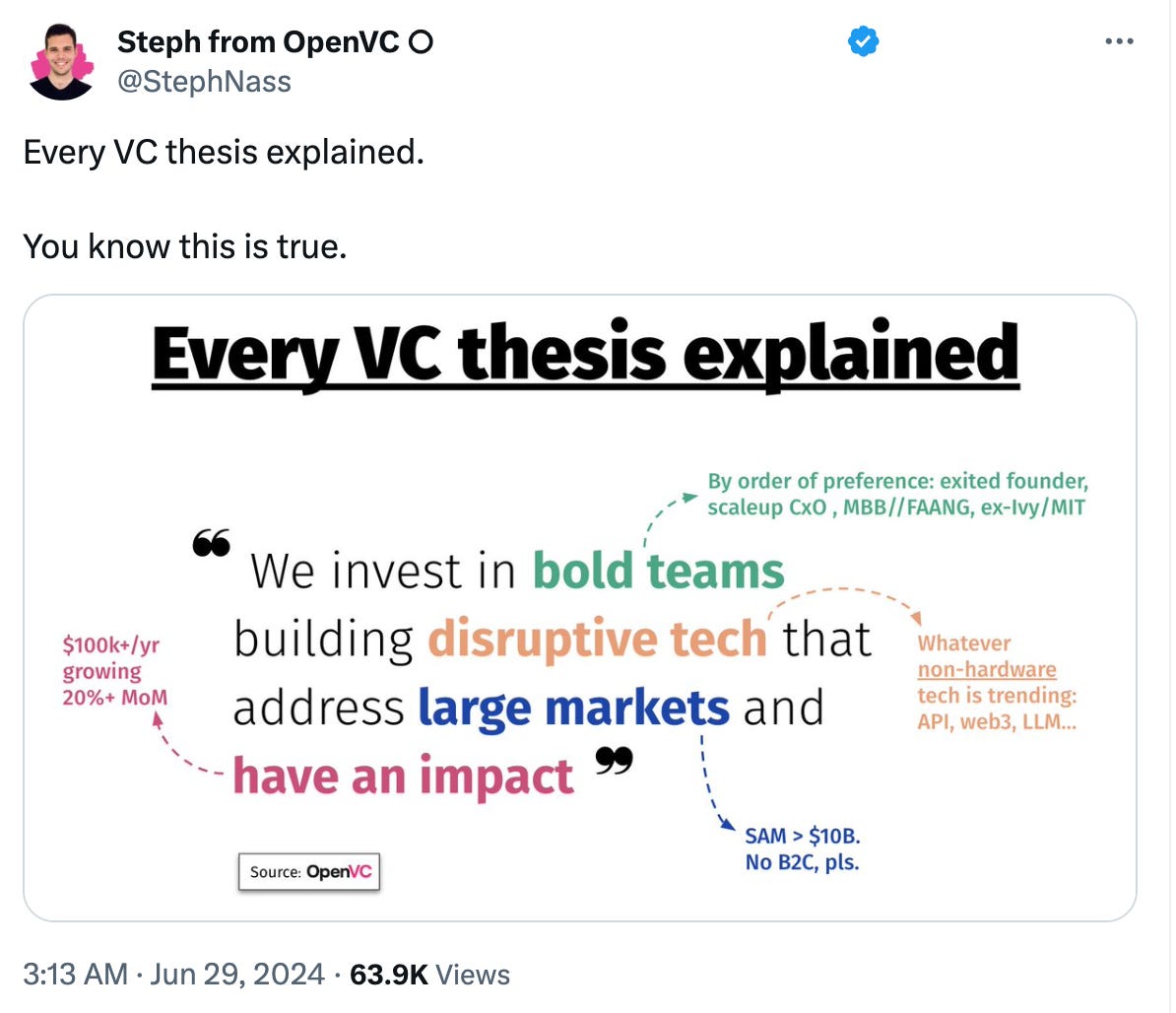

Look, the reality is (and this is global, and not just unique to VC) is that privilege exists and this take on X sums it up for many VCs

When affirmative (and I hate this word because of the connotations, but that’s a whole post for another time maybe) action is being taken it often gets blocked. Whether it’s men taking action against the rise of women only spaces and clubs, or courts banning funds being invested for and by women of colour albeit in the US.

I don’t know what the answer is the form of a silver bullet, or if there is one, but I’m confident in saying it starts with investing in more, much much more, women of colour. You’ve got to meet people where there are and look at how you can elevate them. Having the same philosophy or criteria for any group that has been marginalised (and more often than not continues to be) as a majority simply doesn’t work.

Top News

Techboard’s funding analysis reveals NSW gets the lion’s share of VC investment, but it’s starting to wane (Startup Daily)

Indigenous-led First Australians Capital banks $20M for its impact fund (Startup Daily)

Agtech DAS and Hex founder Jeanette Cheah honoured in the Victorian governor’s startup awards (Startup Daily | Jeanette Cheah)

BeanstalkAgTech is building a $10M venture studio to back nearly 100 startups focused on drought resilience (Startup Daily)

Telstra is looking to get out of venture capital (Startup Daily | AFR | Albert Bielinko)

Agtech VC Tenacious Ventures plants $18M in first close for Fund II (Startup Daily | AFR)

Airwallex has reported a 93% YoY revenue increase across ANZ (SmartCompany)

80% of MVP Ventures grants awarded to metro Sydney, sparking regional equity concerns (SmartCompany)

Adore Beauty acquires wellness brand iKOU for $25M (BNA)

Meta threatens Australian news ban in media bargaining war (AFR)

Super funds ‘should be forced’ to back start-ups says Employment Hero founder Ben Thompson (AFR)

Female entrepreneurs have hit out at sexist attitudes, and male-led VC funds (AFR)

Square Peg Capital partner James Tynan thinks newer Aussie funds will struggle to raise capital (AFR)

Canva founders donated $31.6M last year, new documents show (The Australian)

Canva reaps dividends from $50M developer fund as growth explodes across app marketplace (The Australian)

Adelaide's Space Machines Company strikes deal with India for next satellite launch (Capital Brief)

Employment Hero eyes its first profit as it fends off international challengers (Capital Brief)

WA Innovators Share $8.5M In WA Government Grants (Startup News)

LoanOptions.ai launches new bank statement analysis and insights tool for its customers (StartUp ScaleUp)

Auditor to probe $3.53M cost of legal advice on PsiQuantum (InnovationAus)

Tech leaders on powerful new ARC board (InnovationAus)

WiseTech, PEXA executives Richard White and Eglantine Etiemble join Tech Council board (InnovationAus)

Rayn Ong shares a list of new VC funds and their activity level, since Archangel Ventures Fund launched 2 years ago in June 2022 (Rayn Ong)

Airtree shares a how-to guide for Aussie startups on what they need to know about the Delaware Flip (Airtree)

Matt Perrott, Co-Founder/CEO of BuildPass, shares learnings as they reach the 300 customer milestone (Matt Perrott)

Immutable has partnered with Netmarble's Marblex to create the home of web3 gaming in South Korea (Immutable)

Funding Rounds

1Breadcrumb, a worksite and process management software, has raised $4M led by Five V Capital (Startup Daily | BNA | Capital Brief)

National Renewable Network (NRN), which installs home solar and batteries, has raised $1M in a pre-Series A bridge round led by Investible (Startup Daily | Capital Brief)

Samsara Eco, a plastics recycling startup, has raised a $100M Series A+ round led by Main Sequence and the Singapore sovereign wealth fund Temasek (Startup Daily | SmartCompany | BNA)

Klean, an ESG brand authentication startup, has raised a $725K pre-Seed round led by Prtnr Ventures (Startup Daily)

Diraq, the quantum computing startup, has raised a $10.5M (US $7M) Series A2 extension (Startup Daily | AFR | Diraq)

Affinda, a startup that uses AI to extract unstructured data from documents, has raised $10M (Startup Daily | BNA | AFR)

Aquila, a deep tech startup looking to make wireless power transmission a reality, has raised $2M from Blackbird and Icehouse (Startup Daily | BNA)

Airtasker, the online services marketplace, has raised $5M in an equity-for-media deal from oOh! Media (BNA | Tim Fung)